Mentor With Your Money Through Angel Investing

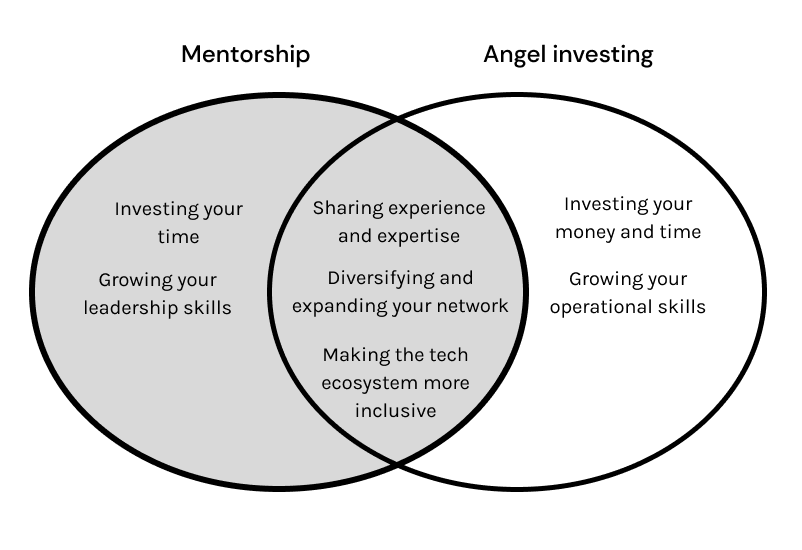

For senior tech workers who have the financial means, angel investing can be a way to grow your network and give back to the tech community. Like mentorship, you regularly meet new people and share your experience to help others grow and learn. In addition, angel investors can focus on providing funding to companies for underrepresented groups or founders from non-traditional backgrounds. This support helps increase diversity and inclusion in the tech funding ecosystem.

Simply put, mentors give their time and expertise to help others and give back. Through angel investing, angels give their time, expertise—and money—to help founders.

What is angel investing?

Angel investing involves an individual (an angel) giving funds to startup founders in exchange for a portion of ownership in the company. Angel investor and operator Danika Koenig elaborates, “Ultimately, angel investing is finding a person, a founder, you really believe in and who you think has an insight and directly financially supporting them.”

The amount of money required to angel invest isn’t minimal. Koenig describes it as a “very expensive hobby.” It requires folks to be comfortable with parting with $500-$50,000 they may never see again. Although angel investors can see high rewards, especially if they invest early in companies that later go on to large exits, many angels will never see returns on their investment. Jason Shen, angel investor and Product Manager at Facebook, shares, “The first rule of angel investing is ‘Don’t invest money you can’t afford to lose.’ This is truly your recreational money. This is not you trying to build financial security for your family.”

Angel investors additionally can choose to support founders beyond writing a check. Founders often look to their angels for advice or referrals because angels are often experienced operators with large networks. For example, an angel with experience in payments may invest in other payment companies, to whom they can provide real-world advice and intros to other experts in the space. Angels aren’t required to be involved in companies this way, but angels’ connections and experience can provide a vital lifeline to founders.

Who can angel invest?

Just about anyone in the United States who is willing to write a check can be an angel investor. Historically, angel investors had to be “accredited” and possess a certain income level or net worth. So angel investing was mostly limited to high net worth individuals, typically from a finance or investing background.

But in 2016, the JOBS Act took effect. This law expanded who could invest in startups by allowing startups to raise $5 million over the course of 12 months from almost anybody. Non-accredited investors could invest through sites like crowdfunding platforms, which opened angel investing to many more people.

Angel investing is still mostly limited to tech and finance professionals with means, but it is possible to get started by investing relatively small amounts.

Unfortunately, because of centuries of racial wealth gaps, most angels today are white men. Although angel investors as a whole are more geographically distributed and more gender diverse, historic inequalities and systemic barriers persist. Angels in tech typically enter the space because they already have the means to do so from inherited wealth and/or they have received windfalls from previous exits at successful tech companies. As tech slowly becomes more diverse, the pool of potential angel investors grows with each IPO or acquisition.

If you're curious about getting started as an angel investor, check out these guides on joining crowdfunding platforms and angel groups.

Angel investors versus venture capitalists

Angel investors and venture capitalists (VCs) are both similar in that they provide funding to startups in exchange for partial ownership. Indeed, most funding rounds for earlier-stage companies include a combination of angel and VC checks.

Typically, both angels and VCs have a thesis to help them decide which companies to invest in. For some, the thesis is based on the stage, business model, and industry of the company. Many angels, however, focus specifically on helping founders who might otherwise get overlooked because they aren’t a “typical” founder or may be in an overlooked sector.

Like VCs, many angels do want to go after exciting, hyped deals because those deals have a higher chance of success, but angels can and do invest based on creating a more diverse tech landscape.

There are a few other important differences between angels and VCs:

- Angel investors act as individuals, whereas VCs act on behalf of their firm.

- Angel investors provide their own personal funds, while VCs raise money from limited partners.

- Typically, angel investors write much smaller checks than VCs do.

- Angel investors don’t expect to see a return on their investment, whereas VCs typically have specific expectations around company growth and potential.

Benefits of becoming an angel investor

If you’re in the United States and in a place financially where you can afford to invest, angel investing provides opportunities to grow your career and give back. Especially for angels who choose to work more closely with founders, they can see benefits to their own networks and knowledge.

First, angel investing teaches you a lot about growing and scaling a company. Koenig says, “I think angel investing has made me just a better business person to understand holistically end-to-end: the product, the dollars and cents, and how do you make this a defensible business?” Because founders sometimes call on angels for help or advice, angels get a front-row seat to the trials of getting a startup off the ground. During this stage, founders have to wear many hats and look to angels’ operational experience to fill in knowledge gaps.

It’s also an opportunity to help grow companies you care about without having to change jobs. Many angels want to be involved with a company they believe in, but their circumstances preclude them from joining a very early-stage startup. So, instead, they invest—and maybe down the line they will be able to join more directly. Stephanie Del Paggio, founder of Little Bun, explains, “I think a lot of angels are builders, and so they want to play a role in building things that they want to see through. Using capital is a great way to accelerate that.”

Additionally, angel investors tend to grow their network quickly. They speak with lots of founders and other angels. Some angels join syndicates that surface deals that the angel can choose to invest in. These syndicates are great places for angels to share companies they’ve found and insights they’ve uncovered. If an angel is investing to support founders from underrepresented groups, they can quickly diversify their network and build relationships in new spaces.

Last but not least, because angels can invest for a variety of reasons, many choose to invest in companies that support underrepresented founders or founders who are not from “typical” tech backgrounds (elite university, Big Tech, etc.). Shen notes that many angels see investing “as philanthropy with a chance of [the money] coming back.” He compares it to giving money to a nonprofit: “You donate money [and] it’s definitely gone….There’s no nonprofit that randomly scales to be super successful. That’s possible with a startup.”

Helping founders

If you’re angel investing to sponsor companies you believe in, you can make a huge difference to founders who might otherwise get overlooked or don’t have the same access to capital. Jason Norman, Co-Founding Partner at Concrete Rose Capital, a VC firm focused on supporting underrepresented founders of color, adds, “A lot of underrepresented founders in particular, just through systemic inequality and different barriers, have not traditionally had access to early stage or friends and family funding. So when you think about angel investors coming in at the earliest stages and having belief and high conviction in founders and their companies, it’s critically important to the funding ecosystem.”

For founders who attended an elite institution, already have a large network, or worked at a name-brand company, finding that first check can be relatively easy. But many founders from underrepresented groups, especially in the earliest stages of fundraising, struggle to find capital. Many VCs are “risk averse” and have a bias that founders from underrepresented groups are riskier investments. Angel investors, because they have lower expectations on ROI, tend to be willing to give capital to companies seen as “riskier” by traditional VCs. Del Paggio adds, “A lot of people get into angel investing because it’s not really about the money—they know that most startups statistically fail. It’s about supporting people in missions that they believe in.”

For founders from underrepresented groups, fundraising in traditionally white-male-dominated spaces can be daunting. As more angels from underrepresented groups join the tech funding ecosystem, the easier it is for founders to find angels who both look like them and may share frames of reference. Angel investing still heavily skews towards white men, so founders who are code switching or navigating an unfamiliar culture benefit from finding angels from a more diverse set of backgrounds.

Angels also often grasp a startup’s work more quickly than VCs, who typically do top-down market research and rely on founders to “convince” them of the problem space. Ronak Trivedi, founder of Pietra, finds that angel investors with domain expertise are both more willing to invest and are more able to help: “Angel investors often come to me and will be like, ‘I worked at this company’ or ‘I’ve been in this space for 20 years and understand what you’re trying to do. I’ve acutely lived this problem,’ [so] you’re not spending too much time convincing them about the problem.”

Because angels have lower ROI demands than VCs, founders can come to angels more openly and honestly than they might with a VC investor. Koenig elaborates, “With an angel, a founder can have a more real conversation because we don’t have 50% ownership of the company or whatever it might be. Because it's a lower-stakes relationship, it allows you as the angel to actually be more of an asset and provide that operational assistance because the founders know that they can bring you problems that they maybe wouldn't bring to more of the adults in the room.”

Angel investing and mentorship

If you’re already a mentor, you’ve had a lot of practice sharing your insights and experiences with others. Angels often do this as well with the founders they support. Because founders must act as almost every role and department in their early-stage company, angels providing insights based on their own operational experience can make a huge difference.

As a mentor, you’re actively giving back to the tech community. Mentors on Merit are opening doors for folks from underrepresented groups as they launch and grow their careers in tech. As an angel investor, you’re doing the same thing for founders who are in their first few years starting and growing their companies.

When you mentor, you meet lots of new people all the time. Each session is an opportunity to make and build a new connection. As an angel, you’ll have similar opportunities to expand your network and meet many new people—founders and other angels—quickly.

Becoming a mentor is a great way to give back, grow your network, and help build a diverse tech community. If you have the means, adding finances to that assistance as an angel investor can allow you to help even more folks in tech.

Curious about mentorship and giving back to the tech community? Apply to be a mentor today.